Hospitality Investment in Vietnam

May 30, 2019

By Potjanee Darakamas

The direct contribution of Travel & Tourism to GDP in 2016 was 4.6% of GDP. This is expected to grow by 6.0% pa to 4.7% of GDP by 2027¹. Visitor exports are a key component of the direct contribution of Travel & Tourism. In 2016, Vietnam generated VND184,811.0bn in visitor exports. By 2027, international tourist arrivals are forecast to total 10,456,000, generating expenditure of VND368,679.0bn, an increase of 6.4% pa². Travel & Tourism is expected to have attracted capital investment of VND121,565.0bn in 2016. Travel & Tourism’s share of total national investment will rise from 9.7% in 2017 to 10.4% in 2027³ . The demand is high and tourism is slated to double in three years while the supply remains one of the lowest in South East Asia. Prices are relatively low along with costs compared to other destinations and this provides a perfect opportunity for investments.

1. Market Structure

The market structure of hospitality and lodging industry is monopolistically competitive by nature due to the following reasons: -

a. The firms are able to influence the price by altering the nature of their product. For example, different levels of star hotels offer differing levels of services and thereby the prices are varied. Even within the city and same star bracket, hotels can vary their prices by being differentiated on service and interior decoration offerings.

b. The products do not have perfect substitutes due to the varied nature of their products. A city hotel with great spa cannot be substituted by a large city hotel with convention facilities. While one caters to leisure tastes, the other is more corporate market oriented.

c. Prices can vary highly driven by branding and advertising. A Holiday Inn Express would perhaps be identical to a local limited services hotel but would be able to change a considerable premium given the brand loyalty.

d. There are many sellers in the market competing with product differentiation. This aspect is explained further below.

e. There are no significant long run entry barriers in the market. This aspect is explained further below.

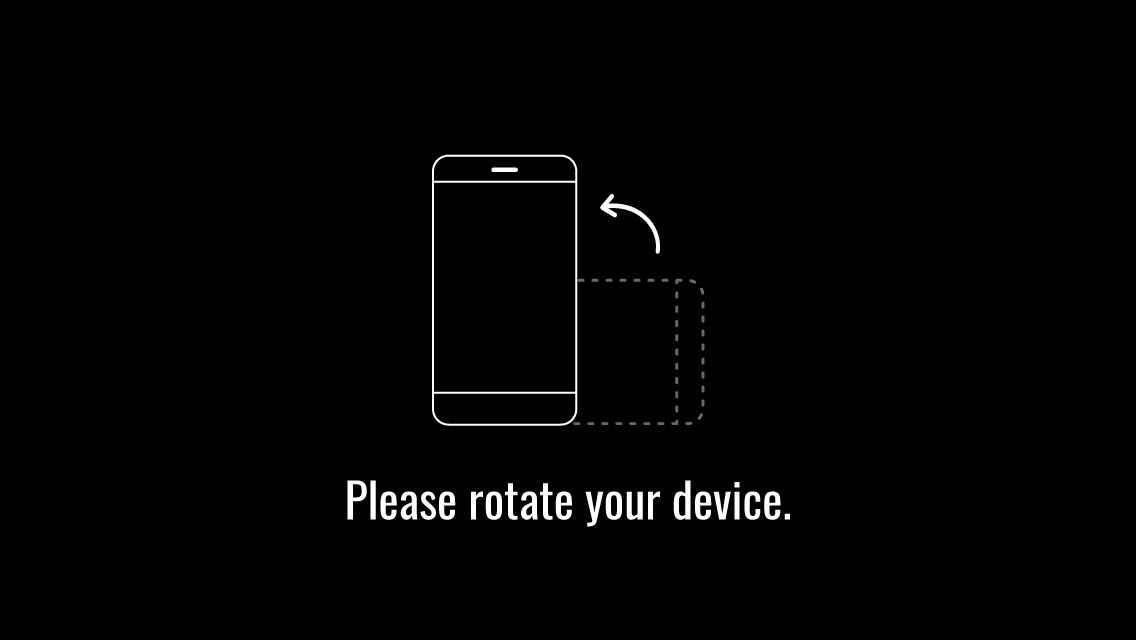

The Vietnam hospitality market can be classified into two main city destinations – Hanoi and Ho Chi Minh City and several other resort/ beach destinations like Da Nang and Phu Quoc. For the purposes of this analysis, we will focus on two city destinations, as the resort destinations largely follow the same characteristics. Geographical boundaries of Vietnam have been selected as the factors affecting the industry are widely influenced by government policies.

Table 1.1 Source: Booking.com 2018

Table 1.1 Source: Booking.com 2018

The market is highly fragmented with low concentration. It is estimated that in 2017, the industry’s top four operators account for 15.2% of the available market share globally giving this industry a low concentration4. In contrast, table 1.1 below shows a much lower presence of major operators in the Vietnam market.

2. Competitive and Strategic Interaction

The main barriers to entry for new players are as under: -

a. Capital – Hospitality is a capital intensive industry. The costs of construction are rising and premium location availability is getting increasingly. Said that, there is a large room for growth in Vietnam as it is relatively underdeveloped.

b. Brand recognition – Major hospitality operators are increasing their presence and deterring local players or new entrants by using their sales network as well as brand loyalty.

c. Labour supply – Hospitality is also a labour intensive industry. The skilled workforce receives better career/ monetary prospects with major international players and therefore, the availability of quality workforce for other players is constrained.

Table 2.1 Source: JLL. May 2017. Hotel Destinations Asia Pacific

Table 2.1 Source: JLL. May 2017. Hotel Destinations Asia Pacific

The market is far from equilibrium because the demand is outpacing supply in the market. The occupancies of both cities are significantly high and the forecasts suggest that the demand is going to double in the next 3 years while the supply is still relatively low. In comparison, other cities with comparable visitor arrivals have much more supply, which offers significant opportunity of growth for Vietnam.

The price levels are bound to rise in the next three years’ period because the demand is out-pacing the supply. Also in comparison to other markets the prices are relatively low in Vietnam. With the increase in concentration of major players, product differentiation would further lead to price rise in the market. This trend would continue until the price reaches the equilibrium.

3. Demand and Costs

Price elasticity of demand is largely influenced by availability of substitutes. Considering the hospitality industry as a whole, a substitute that is emerging is the conversion of other forms of accommodation to hospitality. This trend has been sparked by AIRBNB where residential owners can rent their units as a substitute to hotels. Presently, this substitute has very little impact on the industry in Vietnam and its influence is largely related to cheaper forms of accommodation.

Substitution can also take place between the various offerings within the hospitality industry. Theoretically, upon increase of prices, a luxury guest may move to a more basic form of accommodation. However, this will not impact the price elasticity of demand for the hospitality industry as a whole because the demand continues to be within the industry albeit within different tiers. Anyway, such substitution does not hold true for Vietnam because the price levels are relatively low.

Demand for hospitality in Vietnam is largely inelastic in the short term because of the following factors: -

a. The price levels are relatively low compared to other destinations in South East Asia.

b. The supply is still low and continues to be low for the next 3 years.

c. The demand is high supported by a variety of macro-economic factors. Infrastructure spending by the Government is 5.8% of GDP5 , second highest in Asia.

d. Low substitution possibilities. Vietnam would be the lowest priced leisure and MICE destination in SEA among other comparable destinations. Corporate travellers cannot substitute to other destinations due to the presence of their businesses in Vietnam.

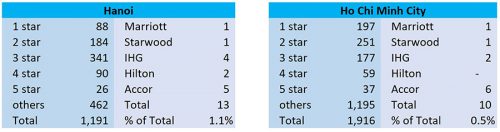

Quantitatively, Price elasticity of demand = Change in Quantity demanded/ Change in price. As the prices are relatively low, a large change in price would be required to change the quantity. Let’s assume if the prices in HCMC go up to the same levels as Yangoon (table 2.1 and table 3.1) and the occupancy drops to the same level, following would be the price elasticity of demand: -

PE = 27.3%/ 28.2% = 0.97

Table 3.1 Inelastic demand

Table 3.1 Inelastic demand

This hypothetical case would still reflect an inelastic demand as the elasticity is less than 1.

Demand continues to grow in Vietnam as we have seen earlier which would further add to inelasticity.

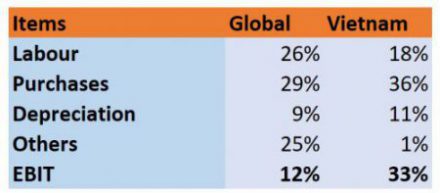

Cost structure of the global industry as a whole vs Vietnam is shown below, which shows much higher profits in VN. It is clear that both fixed and variable costs are relatively low. In a monopolistic competitive industry, costs are bound to increase over time and therefore the current opportunity of maximising profits will not last in the longer run.

Table 3.2 Sources – Global from IBISWorld and Vietnam from Asset World Corporation

Table 3.2 Sources – Global from IBISWorld and Vietnam from Asset World Corporation

4. Barriers to Entry

There are no significant barriers to entry in the monopolistic competitive environment. Apart from the strategic barriers by incumbents as described in point 1 above, the only barrier is land rights. Vietnam is a socialist country and land is considered to belong to people. Therefore, foreign entrants can only lease land but cannot own it.

Another barrier which applies to all industries is the ownership of a JSC in Vietnam. JSC is the only vehicle which can issue shares to public/ participate in capital markets and foreign ownership is not allowed more than 49% of a JSC.

5. Entry Strategy

There are a variety of factors which suggest that there are ample opportunities to maximise profits in the short run: -

1. High and inelastic demand

2. Low supply, particularly of major brands

3. Macroeconomic propulsion

4. Low costs

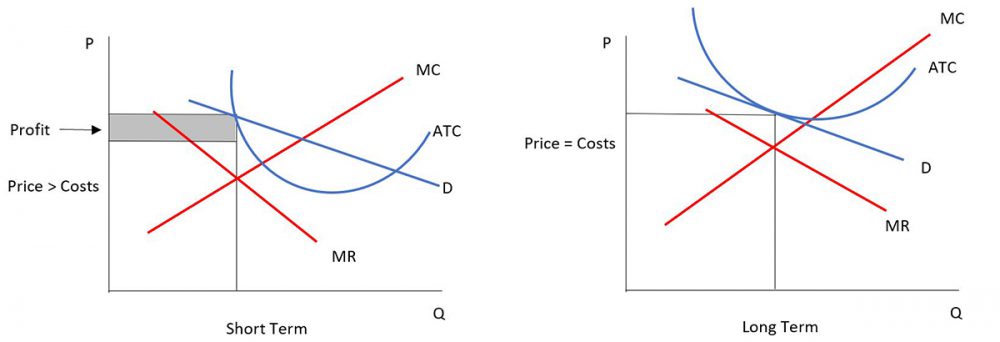

These factors would change in the long run and profits in a monopolistic competition will reduce to zero as costs would increase as shown in table 5.1.

Therefore, the entry strategy should be as under: -

a. Enter with a major brand (as they have low presence in the market);

b. Good Product differentiation, which allows for highest possible prices.

As the marker is highly labour intensive, the incumbents would try to retain talent and this may lead to some cost pressure. However, as the suggested entry is with a major brand, talent pull would be high.

As the market is not in equilibrium and demand is inelastic, the prices of the new entrant should be pegged high.

Table 5.1 Short term and long term profit maximisation

1 World Travel & Tourism Council. 2017. Travel & Tourism. Economic Impact 2017. Vietnam

2 World Travel & Tourism Council. 2017. Travel & Tourism. Economic Impact 2017. Vietnam

3 World Travel & Tourism Council. 2017. Travel & Tourism. Economic Impact 2017. Vietnam

4 IBISWorld. 2017. IBISWorld Industry Report. Global Hotels & Resorts. April 2017

5 JLL. 2017. Vietnam. Spotlight on the Accommodation and Tourism Industry. Hotels and Hospitality Group. July 2017